It might not make a huge difference now, but it could make a massive impact on your earnings in the future.

Irish investment and insurance intermediary

Clear Financial have warned that Irish workers – particularly those in their 30s – who started their career at the beginning of the recession in Ireland might have halved their retirement pot potential by stalling starting a pension.

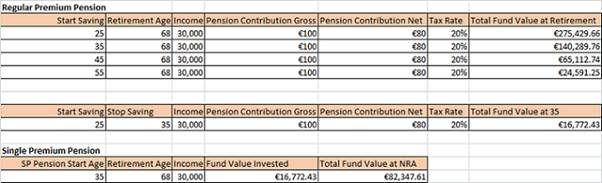

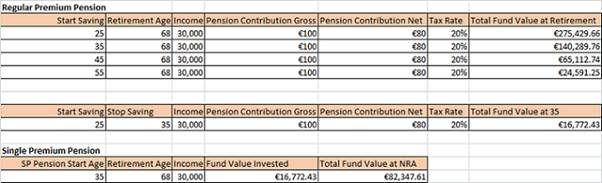

According to figures prepared by Clear Financial, based on someone with an annual income of €30,000 making a pension contribution of €100 per month (which costs just €80 per month due to available tax relief), someone who starts a pension aged 25 could have a pension fund worth almost double that of someone who starts a pension aged 35 (see table below).

Someone who makes that contribution from the age of 25, for example, will have access to a fund of €275,429.66 by the time they retire aged 68, compared to a figure of €140,289.76 for someone who starts it aged 35.

Michael Keating, QFA and Senior Financial Adviser at Clear Financial believes the recession has a lot to answer for in terms of people stalling on starting pensions. “It has been 10 years since Ireland started its decline into recession and we believe that when this happened, lots of workers put the idea of pension saving on hold until they were able to weather the financial storm that was passing,” Keating said.

“Since then many of these people, possibly despite the best of intentions, simply haven’t managed to devote any time or money into setting up a pension and saving for retirement. We are really calling on these people to sit up and take note – every year you put it off costs you.”

Clear Financial say that the motive behind presenting the figures was not to alarm those who might not have started a pension, but to prompt them into action.

“We certainly don’t want people who don’t have a pension in place to think “We’re doomed in retirement,” Keating added.

“We just want to spur them into making sure they have a decent income in retirement by taking steps now. So too with those pension savers who decided to pause or reduce contributions during those financially challenging years.

“We would advise these people, who hopefully might find themselves in a better financial position now, to consider restarting their pension saving habits. The figures really do drive home the point that the longer you wait, the bigger the negative impact on your pension pot.”

A survey by Clear Financial in 2016 revealed that while 66% of Irish people thought that a pension should be started while people are in their 20s, less than half of young adults (18-34) felt that way compared to 73% of 35-54 year olds.

Michael Keating, QFA and Senior Financial Adviser at Clear Financial believes the recession has a lot to answer for in terms of people stalling on starting pensions. “It has been 10 years since Ireland started its decline into recession and we believe that when this happened, lots of workers put the idea of pension saving on hold until they were able to weather the financial storm that was passing,” Keating said.

“Since then many of these people, possibly despite the best of intentions, simply haven’t managed to devote any time or money into setting up a pension and saving for retirement. We are really calling on these people to sit up and take note – every year you put it off costs you.”

Michael Keating, QFA and Senior Financial Adviser at Clear Financial believes the recession has a lot to answer for in terms of people stalling on starting pensions. “It has been 10 years since Ireland started its decline into recession and we believe that when this happened, lots of workers put the idea of pension saving on hold until they were able to weather the financial storm that was passing,” Keating said.

“Since then many of these people, possibly despite the best of intentions, simply haven’t managed to devote any time or money into setting up a pension and saving for retirement. We are really calling on these people to sit up and take note – every year you put it off costs you.”

Clear Financial say that the motive behind presenting the figures was not to alarm those who might not have started a pension, but to prompt them into action.

“We certainly don’t want people who don’t have a pension in place to think “We’re doomed in retirement,” Keating added.

“We just want to spur them into making sure they have a decent income in retirement by taking steps now. So too with those pension savers who decided to pause or reduce contributions during those financially challenging years.

“We would advise these people, who hopefully might find themselves in a better financial position now, to consider restarting their pension saving habits. The figures really do drive home the point that the longer you wait, the bigger the negative impact on your pension pot.”

A survey by Clear Financial in 2016 revealed that while 66% of Irish people thought that a pension should be started while people are in their 20s, less than half of young adults (18-34) felt that way compared to 73% of 35-54 year olds.

Clear Financial say that the motive behind presenting the figures was not to alarm those who might not have started a pension, but to prompt them into action.

“We certainly don’t want people who don’t have a pension in place to think “We’re doomed in retirement,” Keating added.

“We just want to spur them into making sure they have a decent income in retirement by taking steps now. So too with those pension savers who decided to pause or reduce contributions during those financially challenging years.

“We would advise these people, who hopefully might find themselves in a better financial position now, to consider restarting their pension saving habits. The figures really do drive home the point that the longer you wait, the bigger the negative impact on your pension pot.”

A survey by Clear Financial in 2016 revealed that while 66% of Irish people thought that a pension should be started while people are in their 20s, less than half of young adults (18-34) felt that way compared to 73% of 35-54 year olds.